The COMPLETE Real Estate Course

Ready to start building wealth through real estate? The COMPLETE Real Estate Course provides step-by-step guidance for every stage of real estate investing, from buying your primary residence, your first residential or commercial rental investment property, investing in REITs, managing your mortgage, cash flow, taxes and so much more!

Watch Promo Enroll Now (free for Silver, Gold, Platinum or Diamond MBA Students*)

* Past, current and future MBA students please see the last lecture of your curriculum for how to access the course for free.

Real estate is one of the most reliable ways to build wealth and secure your financial future. But if you're feeling overwhelmed by complex terms, unsure where to start, or nervous about making costly mistakes, you're not alone—and you're in the right place.

Please scroll down for the comprehensive curriculum.

Who is this course for? As explained in the first lecture of the course (and per the curriculum), there are 4 ways to take this comprehensive course; at the beginning of the lectures, you will see the following letters, which correspond to the 4 ways to take the course: PR = Primary Residence Track Lessons and Exercises, RIR = Residential Investment Rental Track Lessons and Exercises, CIR = Commercial Investment Rental Track Lessons and Exercises, ALL = All Track Lessons and Exercises

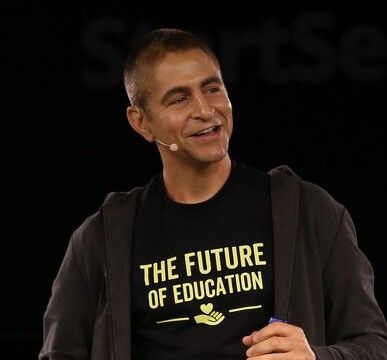

Your Instructor

Chris Haroun is the CEO & Founder of the Haroun MBA Degree Program®, a 400+ hour online business program. He has sold over 2,000,000 courses in 196 countries and has been featured in Business Insider, NBC, Forbes, CNN, Inc., and Entrepreneur.

A Columbia MBA graduate and former Goldman Sachs professional, Chris has raised and managed over $1 billion in his career. He has also worked at Citadel, Accenture, and multiple startups, including a firm that invested in Facebook pre-IPO.

As a business school professor and startup mentor, he has lectured at Stanford, Berkeley, and McGill, where he is a Dobson Fellow. His passion for education extends to philanthropy, focusing on building schools in Rwanda and funding scholarships worldwide.

Course Curriculum

-

Start[PR/RIR/CIR/ALL] Section 2.1: Introduction to Section 2 (What, Why and How) (1:09)

-

Start[RIR/CIR/ALL] Section 2.2: “I” for Income (13:52)

-

Start[RIR/CIR/ALL] Section 2.3: “D” for Depreciation Part 1 of 2 (9:29)

-

Start[RIR/CIR/ALL] Section 2.3: “D” for Depreciation Part 2 of 2 (9:09)

-

Start[PR/RIR/CIR/ALL] Section 2.4: “E” for Equity (13:19)

-

Start[PR/RIR/CIR/ALL] Section 2.5: “A” for Appreciation Part 1 of 2 (14:14)

-

Start[PR/RIR/CIR/ALL] Section 2.5: “A” for Appreciation Part 2 of 2 (8:23)

-

Start[PR/RIR/CIR/ALL] Section 2.6: “L” for Leverage (3:39)

-

Start[PR/RIR/CIR/ALL] Section 3.1.1: Introduction to Section 3.1 (What, Why and How) (2:40)

-

Start[PR/RIR/CIR/ALL] Section 3.1.2: Location, Location, Location Part 1 of 2 (10:25)

-

Start[PR/RIR/CIR/ALL] Section 3.1.2: Location, Location, Location Part 2 of 2 (6:19)

-

Start[PR/RIR/CIR/ALL] Section 3.1.3: Valuing Property Part 1: Price Per Square Foot or Square Meter (Methodology 1) (12:13)

-

Start[RIR/CIR/ALL] Section 3.1.4: Valuing Property Part 2: Gross Rent Multiplier (Methodology 2) (4:33)

-

Start[RIR/CIR/ALL] Section 3.1.5: Valuing Property Part 3: Cap Rate (Methodology 3) (8:52)

-

Start[RIR/CIR.ALL] Section 3.1.6: Valuing Property Part 4: Cost Approach (Methodology 4) (4:26)

-

Start[RIR/CIR/ALL] Section 3.1.7: Valuing Property Part 5: Net Present Value (NPV) (Methodology 5) (7:09)

-

Start[PR/RIR/CIR/ALL] Section 3.1.8: The Real Estate Cycle and When Should You Buy? (11:57)

-

Start[RIR/CIR/ALL] Section 3.1.9: Start Small With Your First Rental Property (4:54)

-

Start[PR/RIR/ALL] Section 3.1.10: Should You Buy a House, a Townhouse, a Condo or a Coop? (5:31)

-

Start[CIR/ALL] Section 3.1.11: Should You Buy Commercial Real Estate? (2:36)

-

Start[CIR/ALL] Section 3.1.12: Should You Buy Land? (2:20)

-

Start[PR/RIR/CIR/ALL] Section 3.1.13: How to Negotiate to Buy Real Estate (8:51)