Introduction to Finance, Accounting, Modeling and Valuation by Haroun Education Ventures

Learn Finance and Accounting from Scratch by an Award Winning MBA Professor, Ivy Grad, worked @ Goldman and VC

Watch Promo

This course will help you understand accounting, finance, financial modeling and valuation from scratch (no prior accounting, finance, modeling or valuation experience is required).

After taking this course you will understand how to create, analyze and forecast an income statement, balance sheet and cash flow statement.

By the end of his course you will also know how to value companies using several different valuation methodologies that I have used during my Wall Street career so you can come up with target prices for the companies that you are analyzing.

By the end of this course you will also know how to analyze financial statements using many different financial ratios/formulas that I have used in my hedge fund, Goldman Sachs and venture capital career.

Lastly, I am teaching this course in a much more visual and entertaining way; I hope you enjoy the course as I always use an 'edutainment' and visualization teaching approach to make complex topics simple/easy to understand.

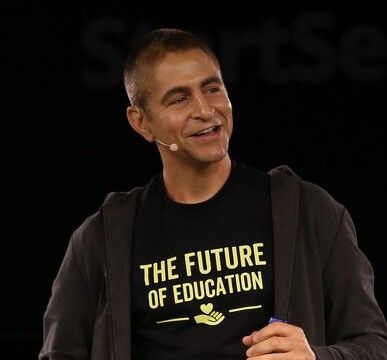

Your Instructor

Chris Haroun is the CEO & Founder of the Haroun MBA Degree Program®, a 400+ hour online business program. He has sold over 2,000,000 courses in 196 countries and has been featured in Business Insider, NBC, Forbes, CNN, Inc., and Entrepreneur.

A Columbia MBA graduate and former Goldman Sachs professional, Chris has raised and managed over $1 billion in his career. He has also worked at Citadel, Accenture, and multiple startups, including a firm that invested in Facebook pre-IPO.

As a business school professor and startup mentor, he has lectured at Stanford, Berkeley, and McGill, where he is a Dobson Fellow. His passion for education extends to philanthropy, focusing on building schools in Rwanda and funding scholarships worldwide.

Course Curriculum

-

StartSpecial Offer

-

Start1. Section 1: Course Introduction & Who is this Course For? (4:44)

-

Start[Optional] Side Note: Get Free Daily Helpful Business & Career Development Videos

-

Start2. Section 2: Why is the Income Statement Important & How Can It Help You Achieve Your Goals _AND_Income Statement Explanation (6:03)

-

Start3. Income Statement Example and Analysis (8:48)

-

Start4. Income Statement Analysis Exercise _AND_ Income Statement Analysis Exercise Answers Explanations (4:25)

-

Start5. Section 3: Balance Sheet Analysis: Why is the Balance Sheet Important & How Can It Help You Achieve Your Goals _AND_Balance Sheet Explanation (3:20)

-

Start6. Balance Sheet Example and Analysis (8:39)

-

Start7. Balance Sheet Analysis Exercise _AND_Balance Sheet Analysis Exercise Answer Explanations (3:59)

-

Start8. Section 4: Cash Flow Statement Analysis: Why is the Cash Flow Statement Important + How Can It Help You Achieve Your Goals _AND_Cash Flow Statement Explanation (3:39)

-

Start9. Cash Flow Statement Example (6:34)

-

Start10. Cash Flow Statement Analysis Exercise _AND_Cash Flow Statement Analysis Exercise Answer Explanations (3:03)

-

Start11. Financial Statement Analysis Conclusion (How All 3 Statements Are Related) (2:17)

-

Start12. Section 5: Financial Modeling Part 1 of 4: Introduction and Best Practices: Why is Financial Modeling Important & How Can It Help You Achieve Your Goals (2:04)

-

Start13. Financial Modeling Best Practices (5:13)

-

Start14. Section 6: Financial Modeling Part 2 of 4: Where Do I Get Historical Data From? Why is Investor Relations+SEC.Gov Important & How Can It Help Me Build Models (2:01)

-

Start15. Introduction to Investor Relations (A Great Model Data Source) (11:01)

-

Start16. Introduction to SEC.gov (Another Great Model Data Source) (7:07)

-

Start17. Yahoo Finance (Another Great Model Data Source) (5:28)

-

Start18. What is the Quarterly Earnings Call and Why Is It Important for Modeling Purposes? (4:35)

-

Start19. Section 7: Financial Modeling Part 3 of 4: Case Study Introduction and What You Will Learn in this Section (2:05)

-

Start20. Qualitative Analysis of LinkedIn (2:22)

-

Start21. What is the Total Addressable Market for LinkedIn and Why is this Important? (6:10)

-

Start22. LinkedIn Model Introduction (4:15)

-

Start23. LinkedIn Model Discussion in More Detail (Historical Data Only) (17:47)

-

Start24. Forecasting the LinkedIn Model (16:34)

-

Start25. Section 8: Financial Modeling Part 4 of 4: Financial Modeling Exercises Introduction _AND_ Financial Modeling Exercise (4:45)

-

Start26. Financial Modeling Exercise Explanation (10:09)

-

Start27. Section 9: Valuation Part 1 of 6: Introduction and Best Practices: Introduction to Valuation and More Detail on Growth Versus Value and PE + PR + DCF Overview _AND_ MENTION OF PDF 25 Valuation and Modeling Best Practices (6:01)

-

Start28. Section 10: Valuation Part 2 of 6: Discounted Cash Flow (DCF). What is DCF, Why is it Important and How Does it Work? (6:17)

-

Start29. Calculating the Terminal Value (2:42)

-

Start30. Calculating the Weighted Average Cost of Capital (WACC) (6:23)

-

Start31. DCF Example (7:45)

-

Start32. DCF Exercise (2:01)

-

Start33. DCF Exercise Answer Explanations Part 1 of 2 (19:28)

-

Start34. DCF Exercise Answer Explanations Part 2 of 2 (10:31)

-

Start35. Section 11: Valuation Part 3 of 6: Price to Revenue: What is Price to Revenue and Why Do We Need to Base a Target Price on this Ratio (2:11)

-

Start36. Price to Revenue Example + Price to Revenue Valuation Exercise and Answer (7:18)

-

Start37. Section 12: Valuation Part 4 of 6: Price to Earnings & Additional Valuation Methodologies: Introduction to P/E and Why it Matters (2:48)

-

Start38. Price to Earnings Example _AND_ THIS IS EXCEL ONLY_Price to Earnings Exercise _AND_ Price to Earnings Exercise Answer Explanations (8:34)

-

Start39. Section 13 & 14: Valuation Sections 5 & 6: Final Target Price Calculation & "TAM Sanity Check," and Comparing TAM to the Target Price (3:42)

-

Start40. Section 15: Assessing Financials with Formulas: Introduction to Formulas _AND_ Amazing Formulas to Assess Financials (8:08)

-

Start41. Exercise on Using Formulas and Answers (10:44)

-

Start42. Section 16: Course Conclusion (2:00)